|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

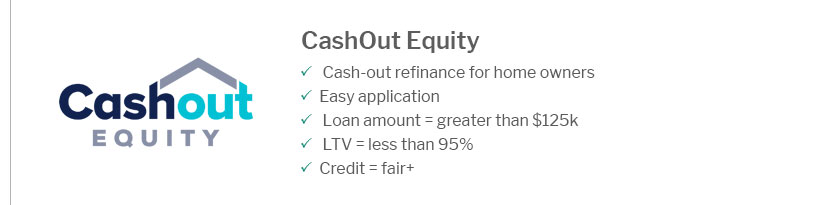

Understanding What Refinance Means: A Comprehensive GuideRefinancing is a financial strategy that involves replacing an existing loan with a new one, typically to improve terms or access equity. This process can seem complex, but with a thorough understanding, it can be a valuable tool for managing your finances effectively. Reasons to Consider RefinancingLowering Your Interest RateOne of the most common reasons to refinance is to secure a lower interest rate. A reduced rate can decrease your monthly payment and save you significant amounts over the life of the loan. Changing Loan TermsRefinancing allows you to adjust the terms of your loan. You might switch from a 30-year mortgage to a 15-year mortgage to pay off your home sooner, or extend the term for lower payments. Accessing Home EquityIf you have built up equity in your home, refinancing can allow you to tap into this value. This is known as a cash-out refinance, which can be used for various financial needs such as home improvements or debt consolidation.

For more detailed information on refinancing options, you might explore a conventional fha refinance as an alternative. The Refinancing ProcessEvaluating Your Financial SituationBefore proceeding, assess your financial health. Ensure you understand your current loan terms, credit score, and financial goals. Comparing Loan OffersShop around for the best refinancing offers. Consider factors such as interest rates, fees, and lender reputation.

Deciding between a conventional vs fha cash out refinance can impact your financial strategy and outcomes. Frequently Asked QuestionsWhat does it mean to refinance a loan?Refinancing a loan means replacing your current loan with a new one that has different terms, which can include a new interest rate, loan term, or loan amount. How does refinancing affect my credit score?Refinancing can temporarily lower your credit score due to the credit inquiry and the new account, but it can improve your score in the long run if you make payments on time. Can I refinance if I have bad credit?It is possible to refinance with bad credit, but you may face higher interest rates. Working with a lender who specializes in bad credit refinancing can help. How often can I refinance my home?There is no set limit on how often you can refinance, but it is important to consider closing costs and whether the benefits outweigh the costs. Understanding refinancing is crucial for making informed financial decisions. By considering your options carefully, you can potentially save money and improve your financial situation. https://en.wikipedia.org/wiki/Refinancing

Refinancing is the replacement of an existing debt obligation with another debt obligation under a different term and interest rate. https://www.centralbank.net/learning-center/what-does-refinance-mean-for-your-mortgage/

Refinancing a mortgage means replacing an old loan with a new one to lower refinance rates, shorten the term, or access cash. Check out our guide! https://www.experian.com/blogs/ask-experian/what-is-refinancing/

It's typically done to improve terms for the borrower, such as getting a lower interest rate or shorter loan term. For instance, you might ...

|

|---|